The 2-Minute Rule for Social Security copyright

The 2-Minute Rule for Social Security copyright

Blog Article

“Our Business conducts ongoing analytics of on the web transactions and we try to look for anomalous actions, and when we see new attributes, we flag People and put into practice supplemental controls to stop any actions that is certainly potentially fraudulent,” reported Joe Lopez, assistant deputy commissioner for analytics, evaluate and oversight at Social Security.

Previous week, a purported member of USDoD recognized only as Felice informed the hacking Discussion board that they have been presenting “the full NPD databases,” In keeping with a screenshot taken by BleepingComputer.

If a employee delays acquiring Social Security retirement Rewards until eventually when they reach complete retirement age,[fifty five] the reward will increase by two-thirds of one p.c on the PIA every month.[fifty six] Following age 70 there are no far more increases because of delaying Advantages. Social Security employs an "normal" survival charge at your complete retirement age to prorate the increase in the level of benefit increase to make sure that the overall Added benefits are around a similar Each time a person retires.

Additionally, enhanced investing with the Social Security method will arise at the same time as increases in demand for Medicare, due to the growing older of the infant boomers. A person projection illustrates the connection between The 2 applications:

After we receive your software, we’ll evaluate it and contact you if We have now any thoughts. We'd request more files from you in advance of we can easily system your software.

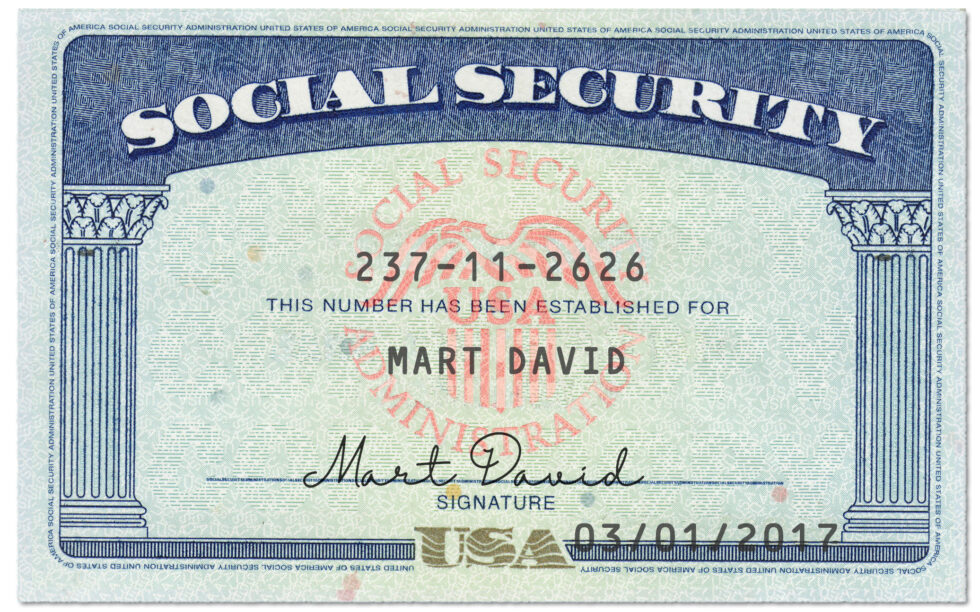

A huge number of people getting Social Security Advantages have had their money diverted into legal accounts. Right here’s what to be aware of.

The reward for a child on a residing guardian's record, is 50% in the PIA. For a surviving child, the advantage is 75% with the PIA. The benefit volume could be decreased if overall Rewards over the file exceed the family optimum.

The retirement Gains software course of action follows these basic measures, irrespective of whether you implement online, by cellular phone, or in person:

Proposals to reform in the Social Security program have led to heated debate, centering on funding of This system. Specifically, proposals to privatize funding have caused great controversy.

You could opt for to extend your time over the page if you have this warning. Having said that, after the third warning, you must shift to a different webpage or your information will not be saved.

Due to switching needs or own preferences, anyone may well go back to do the job following retiring. In such a case, it can be done to obtain Social Security retirement or survivors Advantages and operate at the same time. A employee who is of total retirement age or more mature could (with husband or wife) hold all benefits, right after taxes, regardless of earnings. But, if this employee or maybe the worker's spouse are youthful than full retirement age and acquiring Added benefits and get paid "an excessive amount", the advantages will probably be decreased. If Performing under complete retirement age for the whole 12 months and receiving Rewards, SSA deducts $1 from the employee's profit payments For each $two attained higher than the annual Restrict of $fifteen,120 (2013). Deductions stop when the benefits are lowered to zero along with the employee will get yet another calendar year of money and age credit rating, marginally increasing long term Rewards at retirement.

I didn't have to have a courtroom order at some time (pre 9/11), I presented the SSA that has a notarized sort and was given a brand new card with my new title. How can I accessibility my records While using the SSA to point out that I changed my identify with your agency to make sure that I'm able to ahead it to your requesting Division for my migration case?

"Distributional Effects of Cutting down the associated fee-of-Living Changes". Social Security Administration Research, Figures, and Plan Evaluation. Retrieved January 26, 2020. ^ IRC § 6672 presents "Anyone needed to gather, truthfully account for, and shell out more than any tax imposed by this title who willfully fails to collect such tax, or truthfully account for and shell out around these tax, or willfully makes here an attempt in almost any fashion to evade or defeat any this sort of tax or perhaps the payment thereof, shall Besides other penalties provided by legislation, be liable into a penalty equivalent to the entire number of the tax evaded, or not collected, or not accounted for and paid out about." ^

You might be able to receive retirement Positive aspects on your spouse or previous wife or husband’s document. Likewise, your husband or wife or family member might be able to get Advantages website on your document if they qualify. Learn more about Positive aspects For Your Relatives.